If you are a seafarer (and especially living in India), you may have been quite surprised by the cacophony that a few Mutual Funds (MF) companies and AMFI (Association of Mutual Funds of India) have been created by a plethora of ads in recent months.

The concept of SIP or Systematic Investment Plan has been around for quite some time and was used sparingly by only a few people who were aware of the same. As it usually happens, the very few who understand the concept and the underlying calculations of a systematic plan of investment have gained in the past.

SIP works as a simple concept, by way of which a fixed amount is deducted from your bank account and deposited with the AMC (Mutual Fund Company) to buy units of a Debt or Equity fund. Depending upon the NAV of that day units are credited to your Folio. This works fine for everyone in most cases and gives good returns to those who carry their SIPs through Bull and Bear cycles which means ups and downs of the stock market for a large number of years.

As a Seafarer dedicated to financial planning, I found a few practical difficulties for Seafarers while using SIP :

Firstly you must remember that as a seafarer you have far more investible funds than your shore counterpart. This means that you should have more opportunities to invest and should take more precautions and steps to put your FULL money to FULL use. No money should lie idle anywhere. Even the uncertainties like medical emergencies should be properly quantified and provisioned for. Since we are, by the help of these articles, trying to earn maximum in lesser number of years, we cannot and should not waste money and opportunity of getting a higher return.

Less spreading of investment across time frame: Usually the MF companies offer only monthly SIPs, which means you will be able to purchase only once a month. This means that the day you buy the market may be on a high or on a low or may be a mean. This deprives you of an opportunity to divide your money and buy at more number of times in a month.

Confusion: I also tried setting up 5 SIP’s for the same fund, 1 for every week. This may work fine but it will leave you with a problem of checking your bank account for debiting and your MF Folio for crediting of the amount as there is a small chance of a money transfer getting haywire. Add to this 3 or 4 more funds that you may also start your SIPs into. As you can see that will be quite a large no of transaction to track.

Risk of Bank Balance Running Low: You may have planned some important expenses from your bank account which could be 1 or 2 months away while you are on board. With the SIPs eating away the balance, you will always be scared of not having enough money for the expenses- planned or non-planned.

Difficulty in Stopping a SIP: It has been practically experienced by me that if you wish to stop a SIP for some reason, it takes more than a month and sometimes even 3 months to stop it after giving an application. Also in your schemes of things you may not be able to give that application if you and your spouse are on board. This can be an indeed a difficult situation. With some AMCs, if your SIP was started manually (in offline mode), you will not be able to stop it even if you have online access.

However, there is another concept similar to SIP, which is called STP or Systematic Transfer Plan.

Is a process similar to SIP but in this a lump sum is deposited in a debt fund (or can be a equity fund too but is not advised) at one time and a timed transfer of fixed amount can be started from the Debt fund into 1 or more no. of Equity funds. The debt fund selected is usually a Liquid fund or Money market fund since it does not have any entry or exit load.

1. Once your Folio has been generated (through an agent or bank) , you can start the STP into the Equity fund of your choice in the Direct mode. This means, that you will not be paying any commission to anyone and your returns will be higher by about 1% p.a.

2. The number of purchases into the Equity fund from your Debt fund can be more than one, i.e. weekly.

3. The no of STPs from the Debt Fund can be started into more no. of Equity funds without creating much confusion. As I have mentioned earlier there will be a real confusion if you wish to set up weekly SIPs if you find more than 1 fund worth investing in the same AMC.

4. Full utilisation of your Salary: Instead of keeping your 2-3 month’s salary in a NRE savings account at pittance interest waiting for investment opportunity or expenses. You can actually keep 1 to 2 months of expenses only in your savings account and move rest of the salary into a Debt fund of any one or more than one AMC. Now from these Debt funds the small investing amounts that you have decided keeps flowing into the Equity funds of your choice every week. The remaining amount will keep earning a higher “return” than the rate of interest it would have earned in a NRE savings or NRE FD.

5. Easy Termination of STPs : In case you need the money for your use, or you feel that the Equity funds have stopped performing well and you wish to stop and watch future performance. All you have to do is simply stop the STP on the AMC website or simply redeem the complete Debt fund. The very next day the money will reach into your bank account and the STP will automatically be stopped when 3 STPs will not be taking place.

6. Easy Re-Starting of STP: In case you again have funds , e.g. you have gone back on board and your spouse is with you. In such cases I have seen that the salary keeps on accumulating in the infamous (for me) bank account. However in our case all you need to do is just transfer your salary in one or more than on Debt fund and … voila!!! Your STPs will automatically start if it has been less than 3 months. If it has been more than 3 months, it will take you less than 5 minutes to visit the website of the Mutual Fund and start fresh STP. Even if you do not want to start a STP, the funds will keep earning a higher return than in your savings account. In fact the return will be slightly higher than a bank FD, with the advantage of taking your money out anytime without being penalised.

Important: You will find that when you are investing as a NRI, for every STP , there is a certain TDS taking place. i.e. if you mandated a STP of Rs.25000 from your Debt Fund to Equity fund, you will notice that the amount finally buying Equity funds is about 24940 or 24800 or maybe even less. DO NOT be alarmed. This is a legal tax deduction (TDS) taking place because your Rs.25000 have actually appreciated and whatever is the appreciated amount 33% of that has been deducted because you are a NRI. This may be claimed back in your tax return.

If you are a resident, the tax on the Capital appreciation is STILL DUE, but is not deducted. You are still required to pay it when the tax payment is due before 31st March.

In addition, Debt funds in general, have the advantage of being redeemed (or Sold ) on Day 1 and the amount being received in your bank account the very next day.

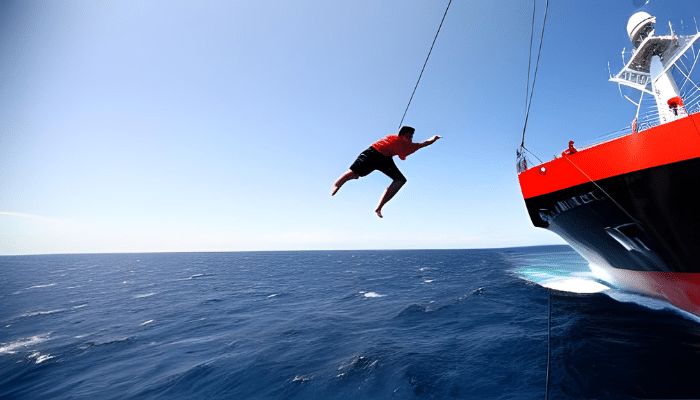

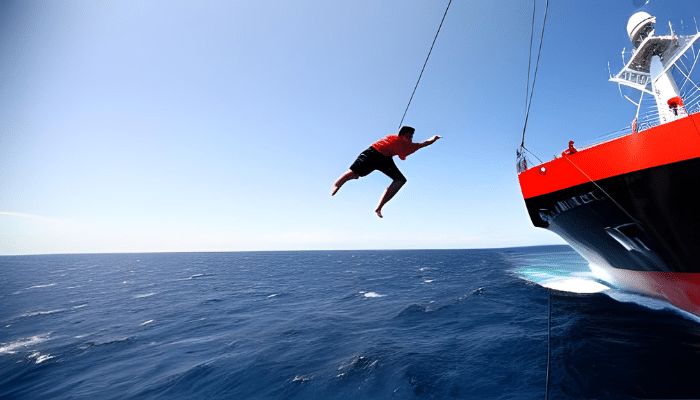

Hence, as you can see, not every tool offered by the companies is the best for you. However we should be able to recognise our limitations and those that our employment imposes on us. Once we recognise and understand those, we can easily find way around those limitations, just as we find ways to work around some challenges on board when any one equipment goes out of commission.

Long term STP will enable you to generate a much higher return than a SIP because here your ENTIRE salary is earning to it’s maximum- most of it in debt and little by little in the Equity. This return will be higher despite paying the TDS.

The type of Debt fund that I would suggest for you to invest as the parent fund for your STPs are Liquid Funds, Money Market funds or Gilt funds. None of these have any exit load and their selection solely depends upon the Fund house whose equity funds you have decided to invest in.

Happy Investing!!!

Note: It is difficult to track things in a single country like India which is so huge and complex. To say that I can advise you for all the countries, whose readers are reading these articles- would be a big lie. I am not acting as your financial advisor. Due to my exposure to different geographical conditions, I have found these products which can be used by us –the hapless Seafarers. The names and methodology of these products may differ from country to country.

Hence my earnest request to you is to please use the power of the internet and find out these products in your country. They are common products and mostly available all over the world. If you find they are named differently in your country, please inform me in the comments that you are so kindly making. It will help us to spread awareness and enhance your own knowledge about your future planning.

We believe that knowledge is power, and we’re committed to empowering our readers with the information and resources they need to succeed in the merchant navy industry.

Whether you’re looking for advice on career planning, news and analysis, or just want to connect with other aspiring merchant navy applicants, The Marine Learners is the place to be.